Wholesale

In view of the expiry of the Yamal contract in 2022, the Group seeks to achieve real diversification of its gas supply portfolio. In this respect, the Group’s key activities include:

- Supporting the Baltic Pipe project by entering into transmission contracts – the Group’s strategic objective is to build a mix of gas supply sources that would be available via the Baltic Pipe, to enable gas imports from new directions and at market prices, thus ensuring flexibility of the gas supply portfolio beyond 2022;

- Developing LNG trading and logistic competencies on the global market – this will help the PGNiG Group create a more flexible gas supply portfolio beyond 2022 as the Group will be able to swiftly balance its gas imports. PGNiG has signed long-term contracts for the supply of liquefied natural gas to Poland which are to be performed after 2022.

- Expanding the resource base in Poland and abroad – by developing and maintaining high gas production levels in Poland and investigating potential for acquiring gas from new directions with a view to strengthening the Company’s competitive position beyond 2022.

In 2021, PGNiG successfully continued its sales strategy and retained the customer base.

In 2021, PGNiG’s sales of high-methane grid gas in Poland amounted to 198.5 TWh (ca. 18.1 bmc), up by 7.5% relative to 184.7 TWh (ca. 16.8 bcm) in 2020. The Group intends to continue efforts to strengthen its presence in the markets of Central and Eastern Europe, including the Ukrainian market, one of the most promising in the region. Given the prevailing market situation and high levels of gas in Ukrainian storage facilities, gas was not imported into Ukraine from the west for a major part of 2021 and the Company’s trading activities in that country focused on transactions to purchase/sell gas held in Ukrainian underground storage facilities.

In response to the significant growth of market demand, in 2021 PGNiG continued to very dynamically grow its small-scale LNG business, where gas is sold in the form of LNG transported by road tankers to regasification facilities with no access to the distribution network. The volume of fuel delivered to end users in the form of liquefied natural gas is growing steadily.

Retail

In implementing the Strategy guidelines, a number of initiatives, projects and operational activities are carried out to support achievement of the strategic objectives in all four defined areas: implementation of a margin defence strategy, optimisation and digitisation of customer service processes, development of product offering, and development of energy consultancy activities.

To achieve the strategic objectives set out in the defined areas, PGNiG OD carries out projects and operational activities in the following areas: new billing system, development of the product offer (including LNG bunkering services, photovoltaic solutions, additional/non-energy products) and development of customer service tools.

In 2021, the Company’s market situation was largely driven by post-pandemic economic changes combined with an unprecedented surge in gas prices on European markets, with which the prices quoted on the Polish Power Exchange (POLPX) are correlated. In particular, strong fluctuations in the prices of fuels and energy carriers on wholesale markets had an adverse effect on PGNiG’s ability to deliver its commercial policy targets in terms of margins and net profit.

Storage

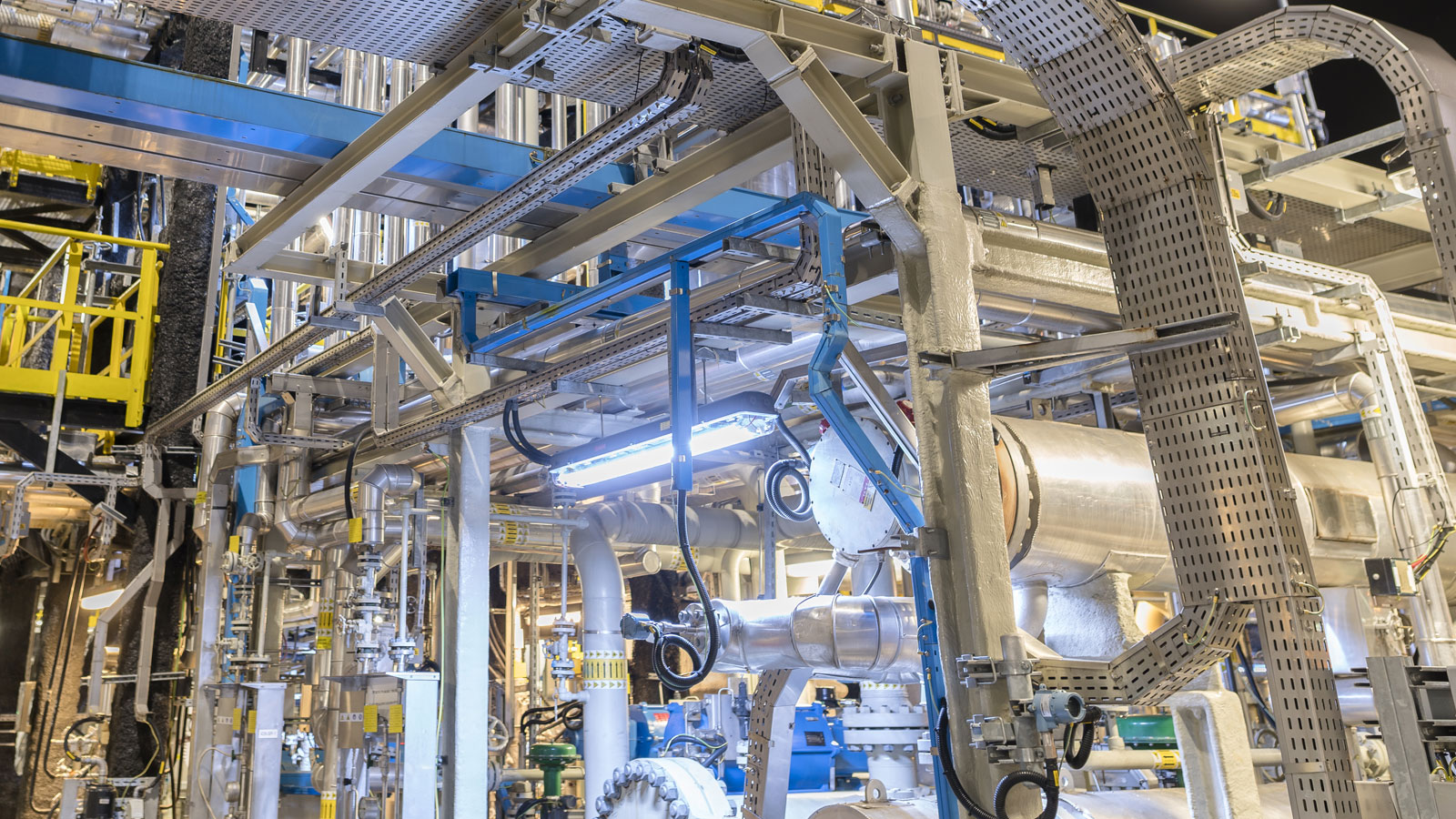

In 2021, GSP had been working on the construction of the Kosakowo CUGSF, comprising five chambers in Cluster B, which were filled with gas and put into operation in September 2021 (the project was finally completed in December 2021).

In addition, as part of the H 2020 project, GSP prepared feasibility studies for an underground hydrogen storage facility at the Mogilno CUGSF and for a project involving large-scale hydrogen storage at salt caverns of the Kosakowo CUGSF. Another feasibility study prepared in 2021 related to possible construction of storage chambers dedicated to underground tankless storage of biomethane, including a process unit at the Mogilno CUGSF.